What Is The Bitcoin Halving?

The Bitcoin Halving is an event that happens after every 210,000 blocks are mined on the Bitcoin network, which works out to roughly every 4 years.

Since it is calculated by the number of blocks mined, and not a certain amount of time passing, the exact date of The Halving is not known.

The Third Halving occured on the 11th of May. You can track the next halving on bitcoinblockhalf.com

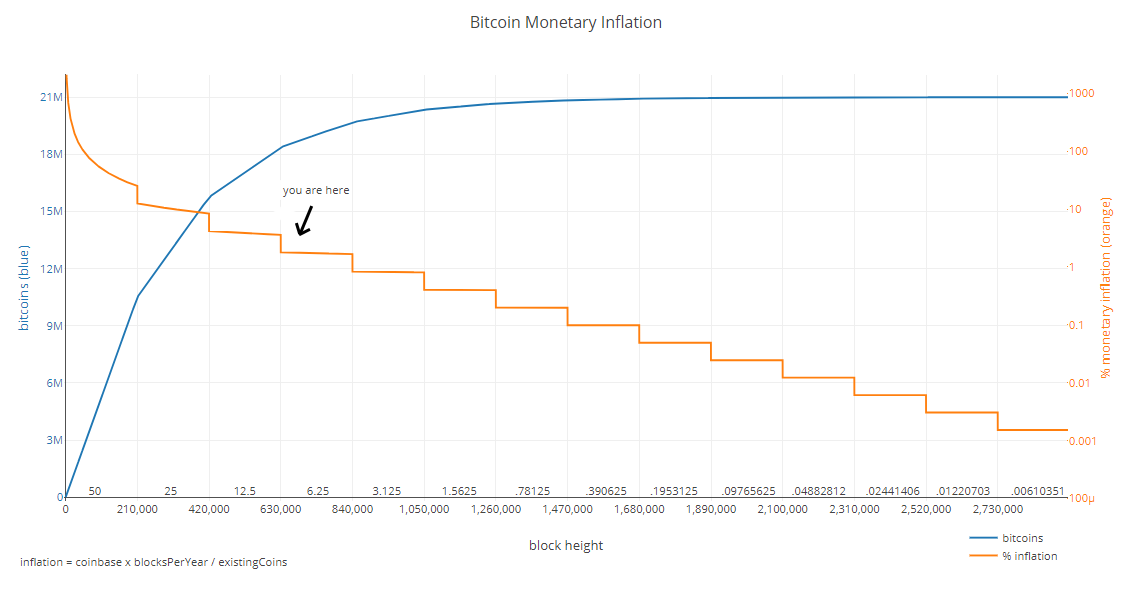

When Bitcoin was first released, the block reward for miners was 50 BTC (plus transaction fees). We are now coming up to the third halving event which will reduce the block reward from 12.5 BTC to 6.25 BTC (plus fees).

Image Source - https://plot.ly/~BashCo/5

Why Does The Miner’s Block Reward Need To Be Reduced

Bitcoin was designed to have a fixed supply of 21,000,000 bitcoin. The way Satoshi designed the emission schedule was nothing short of brilliant, and ensured that this fixed supply was hardcoded in.

One of Bitcoins strongest and most valuable attributes is that it has a set and unchangeable issuance rate. This is unlike centralized fiat currencies which can be printed at will, and can succumb to hyperinflation.

The design of BTC was more in line with a precious metal. A scarce resource that takes energy (PoW) to produce.

The steady addition of a constant of amount of new coins is analogous to gold miners expending resources to add gold to circulation. In our case, it is CPU time and electricity that is expended.

-The Bitcoin Whitepaper

The idea around halving the new supply every 4 years is so that the issuance can incentivise miners early on, while gradually transitioning to fee based rewards only.

The halving allows the total supply to eventually max out at 21 million coins. The last coin will eventually be mined somewhere around the year 2130-2140.

Is The Bitcoin Halving Priced In?

This is a big topic within online Bitcoin discussion forums. Is it priced in? What does that even mean?

On the one hand, everybody knows that the halving is coming. This means the new coin supply is cut in half, which may in turn be halving the sell pressure on exchanges.

The price of Bitcoin is determined by the difference between buyers and sellers, so some may see this as a given that the price will go up.

But if everyone knows this ‘fact’ then surely they would have staked their position accordingly? If so, the thinking is that the price won’t be affected as the market has already acted on it before the fact.

Looking at the significance of the past two Halvings paints a different picture though. The price increased significantly several months after both events.

This may have been due to the market dynamics of a reduced supply, or it may have simply been due to more users and more interest in Bitcoin overall.

It seems that on this subject, we’re dealing with human psychology more than anything. You can never predict the market.

Only time will tell what the third Halving will offer up in terms of price movement.

Share this Article